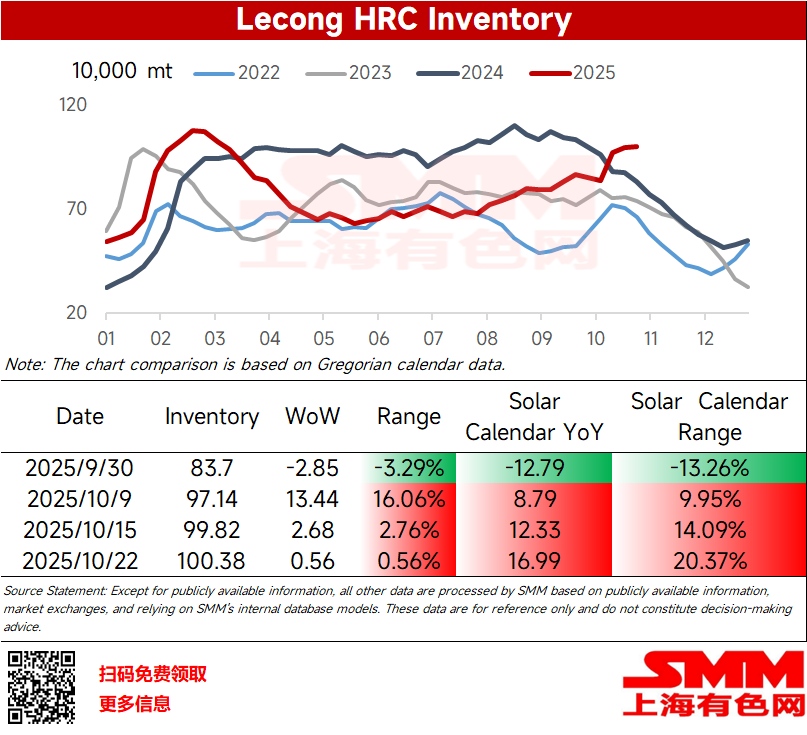

This week, Lecong hot-rolled coil inventory stood at 1.0038 million mt, up 5,600 mt WoW, an increase of 0.56%; up 169,900 mt compared to the same period last year in the Gregorian calendar, a 20.37% increase. Lecong hot-rolled coil inventory has been accumulating since early August, and by this week, inventory has once again broken through the 1 million mt mark. So, can destocking still be achieved during the off-season? Let's examine the fundamentals of Lecong hot-rolled coil.

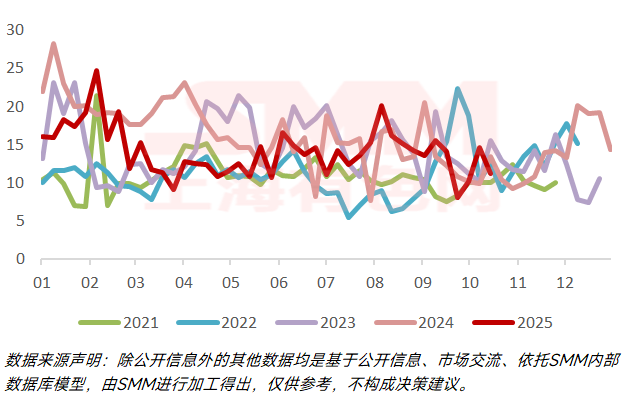

■ August-September Lecong Weekly Arrivals at High Levels Compared to Previous Years, Expected to Remain at Medium Levels Subsequently

This week, shipments destined for Lecong showed a significant decrease WoW. Specifically, arrivals of resources from north China remained stable WoW, while local mainstream resources decreased WoW. This was mainly because WG planned to produce specialty steel grades mid-month, leading to a shift in hot metal, and also to prioritize the supply of base materials, resulting in a lower overall market allocation ratio. From August to October, Lecong arrival data climbed rapidly, reaching high levels compared to the same periods in previous years. Arrival levels dropped in some periods due to typhoons and holidays. Looking ahead, considering that price advantages in east China are stronger than in south China, some steel mills' shipping preferences will continue to shift towards east China. However, WG's hot metal is expected to partially return, so arrivals are projected to remain at medium levels compared to the same periods in previous years in the short term.

Figure 2 - SMM Lecong Arrival Data

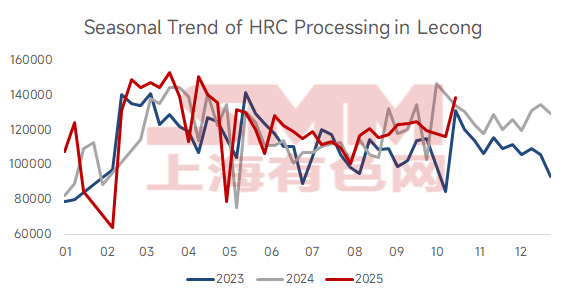

■ August-September Processing at Medium Levels Compared to Previous Years, Expectation of Decline Subsequently

Last week, Lecong hot-rolled coil processing volume was 138,365 mt, an increase of 22,032 mt WoW, up 18.96%, and an increase of 7,955 mt compared to the same period last year, up 6.1%. Under the traditional peak season of "September-October peak season", Lecong's weekly hot-rolled coil processing data was at medium levels YoY, without standout performance. Currently, at the tail end of the peak season, processing levels are expected to decline.

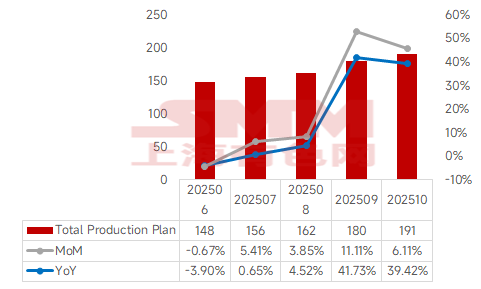

■ Accelerated Inventory Buildup in September Linked to Commissioning of New Capacity in South China

According to SMM production schedule data, the total production of mainstream hot-rolled coil resources in south China in September was 1.8 million mt, up 11.11% MoM and up 41.73% YoY; in October, it was 1.91 million mt, up 6.11% MoM and up 39.42% YoY. Specifically, after Lecong maintained inventory above 900,000 mt for half a year last year, mainstream steel mills began shifting production in September, moving some hot metal to rebar, and further arranging rolling line maintenance plans in October. This led to a significant decrease in the total production of mainstream resources in September and October last year. In contrast, this year, YFDH began operations in August, and production increased further in September and October. This resulted in a 22.44% increase in mainstream resource production in south China in October compared to July. Thus, the significant inventory buildup in Lecong this year is closely related to the market pressure from YFDH's newly commissioned resources. Currently, according to SMM, of the current million-ton inventory, approximately over 200,000 mt belongs to the 1250mm specification.

In summary, some mainstream resources plan to shift shipments to east China due to price spreads. Meanwhile, the market has learned that YFDH may plan to reduce its production load. Subsequently, supply in Lecong is expected to decrease slightly, but overall remains high compared to previous years, while demand is feared to weaken over time. Therefore, according to SMM predictions, a smooth destocking path for Lecong hot-rolled coil remains distant, and inventory may hover at these high levels in the short term. *This report is an original and/or compiled work of SMM Information & Technology Co., Ltd. (hereinafter referred to as "SMM"). SMM legally owns the copyright and is protected by laws and regulations such as the Copyright Law of the People's Republic of China, as well as applicable international treaties. Without written permission, it shall not be reproduced, modified, sold, transferred, displayed, translated, compiled, disseminated, or disclosed to any third party or licensed for use by any third party in any other form. Otherwise, once discovered, SMM will pursue legal action against the infringing party, including but not limited to demanding liability for breach of contract, restitution of unjust enrichment, and compensation for direct and indirect economic losses.

The content contained in this report, including but not limited to any or all information such as news, articles, data, charts, images, sounds, videos, logos, advertisements, trademarks, trade names, domain names, and layout designs, is protected by laws and regulations such as the Copyright Law of the People's Republic of China, the Trademark Law of the People's Republic of China, the Anti-Unfair Competition Law of the People's Republic of China, as well as applicable international treaties concerning copyright, trademark rights, domain name rights, commercial data information rights, and other legal rights. It is owned or held by SMM and its relevant rights holders. Without written permission, any organization or individual shall not reproduce, modify, use, sell, transfer, display, translate, compile, disseminate, or disclose the aforementioned content to any third party or license its use to any third party in any other form. Otherwise, once discovered, SMM will pursue legal action against the infringing party, including but not limited to demanding liability for breach of contract, restitution of unjust enrichment, and compensation for direct and indirect economic losses. The views in this report are based on information collected from the market and comprehensive evaluations by the SMM research team. The information provided in the report is for reference only, and users assume their own risks. This report does not constitute direct investment research advice. Clients should make decisions cautiously and not use this report to replace their independent judgment. Any decisions made by clients are unrelated to SMM. Additionally, losses and liabilities resulting from unauthorized or illegal use of the views in this report are not related to SMM. SMM reserves the right to amend and provide the final interpretation of the terms of this statement.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)